Introduction SBI Current Account: Catering to the Needs of Businesses

Businesses, whether large enterprises or small startups, require a specialized type of bank account to manage their daily financial transactions efficiently. State Bank of India (SBI), a leading public sector bank in India, offers a comprehensive Current Account to cater to the unique needs of businesses, providing them with financial flexibility and a range of services. This review explores the features, benefits, and considerations of opening an SBI Current Account for businesses.

Understanding SBI Current Account:

An SBI Current Account is a type of bank account specifically designed for businesses, allowing them to conduct multiple transactions regularly. Unlike a Savings Account, which is primarily meant for personal savings, a Current Account provides facilities for handling business-related expenses, payments, and receivables with ease.

Key Features and Benefits of SBI Current Account:

- Unlimited Transactions: One of the primary advantages of an SBI Current Account is that it offers unlimited transactions, including deposits, withdrawals, and fund transfers. This unrestricted transaction capability is essential for businesses with a high volume of financial activities.

- Overdraft Facility: SBI Current Account holders can avail of an overdraft facility, which provides them with a pre-approved credit limit. This facility helps businesses manage temporary cash flow gaps and meet urgent financial requirements.

- Wide Branch Network: SBI boasts an extensive branch and ATM network across India, making it convenient for businesses to access their funds and conduct transactions from various locations.

- Online Banking Services: SBI provides robust online banking services, allowing businesses to perform transactions, view account statements, and initiate fund transfers conveniently through Internet banking.

- Dedicated Relationship Manager: For businesses with significant transaction volumes, SBI assigns a dedicated relationship manager to provide personalized assistance and support for all banking needs.

- Cheque Book Facility: SBI Current Account holders receive a chequebook, enabling them to make payments to suppliers, vendors, and employees seamlessly.

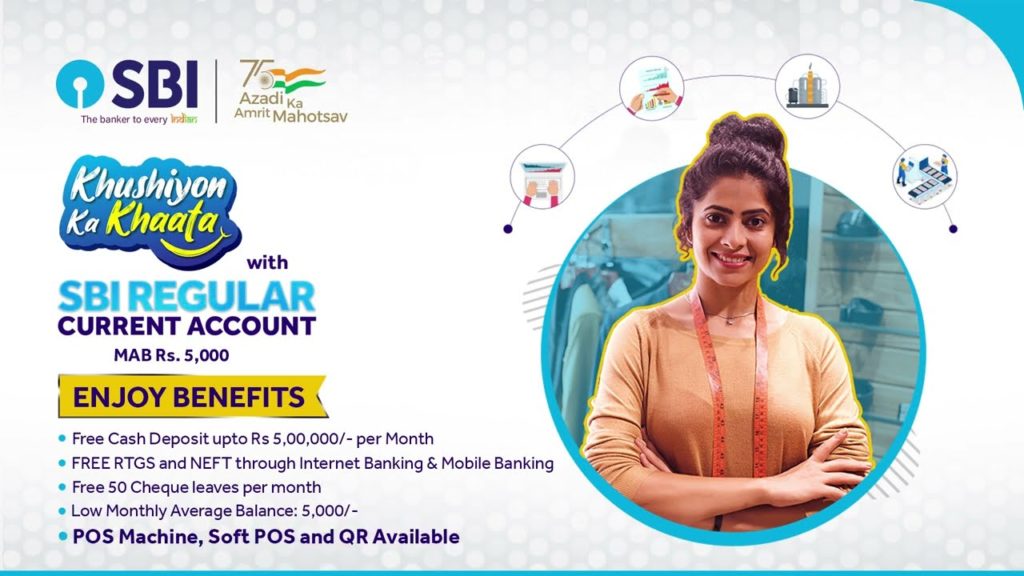

- Multiple Account Variants: SBI offers different variants of Current Accounts tailored to the specific requirements of various business segments. These variants include Regular Current Account, Small Business Current Account, and Premium Current Account.

- SMS and Email Alerts: SBI Current Account holders receive timely SMS and email alerts for all transactions, ensuring enhanced security and constant monitoring of account activities.

Considerations and Eligibility:

Opening an SBI Current Account involves certain considerations and eligibility criteria:

- Business Type: SBI Current Account is specifically meant for businesses, not individual use. Businesses can open a Current Account, including sole proprietorships, partnerships, companies, and more.

- Minimum Balance Requirement: SBI may require a minimum average balance to be maintained in the Current Account. The minimum balance varies based on the account variant and business segment.

- Charges: Businesses should be aware of the costs and fees associated with the Current Account, such as transaction fees, chequebook charges, and account maintenance fees.

- Documentation: Business entities must submit specific documents, including proof of identity, address, business registration, and PAN (Permanent Account Number), while opening an SBI Current Account.

Conclusion: Empowering Businesses with Financial Convenience

An SBI Current Account is an indispensable financial tool for businesses, providing them with the flexibility and convenience to manage daily financial operations efficiently. With a wide range of features, competitive offerings, and a robust branch and online banking network, SBI caters to businesses of all sizes and sectors, empowering them with reliable financial solutions.

Because Knowledge is the Best Investment – Keep Reading –

- Understanding SBI Bank Fees and Charges: A Comprehensive Guide

- SBI HRMS IRJ Online Portal: How to Use SBI HRMS Online Portal and App for All Your HR Needs

- SBI FASTag: Revolutionizing Your Journey

- Take Control of Your Business Finances: SBI Corporate Online Banking Explained

- SBI Current Account: What Is It and How to Open One

- What Is Video KYC? Know More for Different Banks (SBI, ICICI, HDFC)

- Unlocking Financial Ease: Linking Your PAN Card with SBI Bank Account

- How to Generate SBI ATM PIN: A Step-by-Step Guide

- Unleashing the Features and Benefits of the Bank of America EDD Card

- Must-Know Banking Terms: 36 Terms You Should Know for Sure

- SBI Fixed Deposit (FD) Review

- What Is UPI? How to Activate UPI

- SBI Corporate Saral

- Unlock the Benefits: The Ultimate Guide to Opening an SBI Bank Account

- Demystifying SBI Vyapar: Your Comprehensive Guide to Small Business Financing

- Maximizing Benefits: Comparing SBI Debit Cards to Find the Perfect Fit

- SBI Corporate Banking: Everything You Need to Know

- Best Schemes of SBI

- SBI Full Form

- What Is SBI Recurring Deposit (RD)?

- How Good Is SBI Mutual Fund?